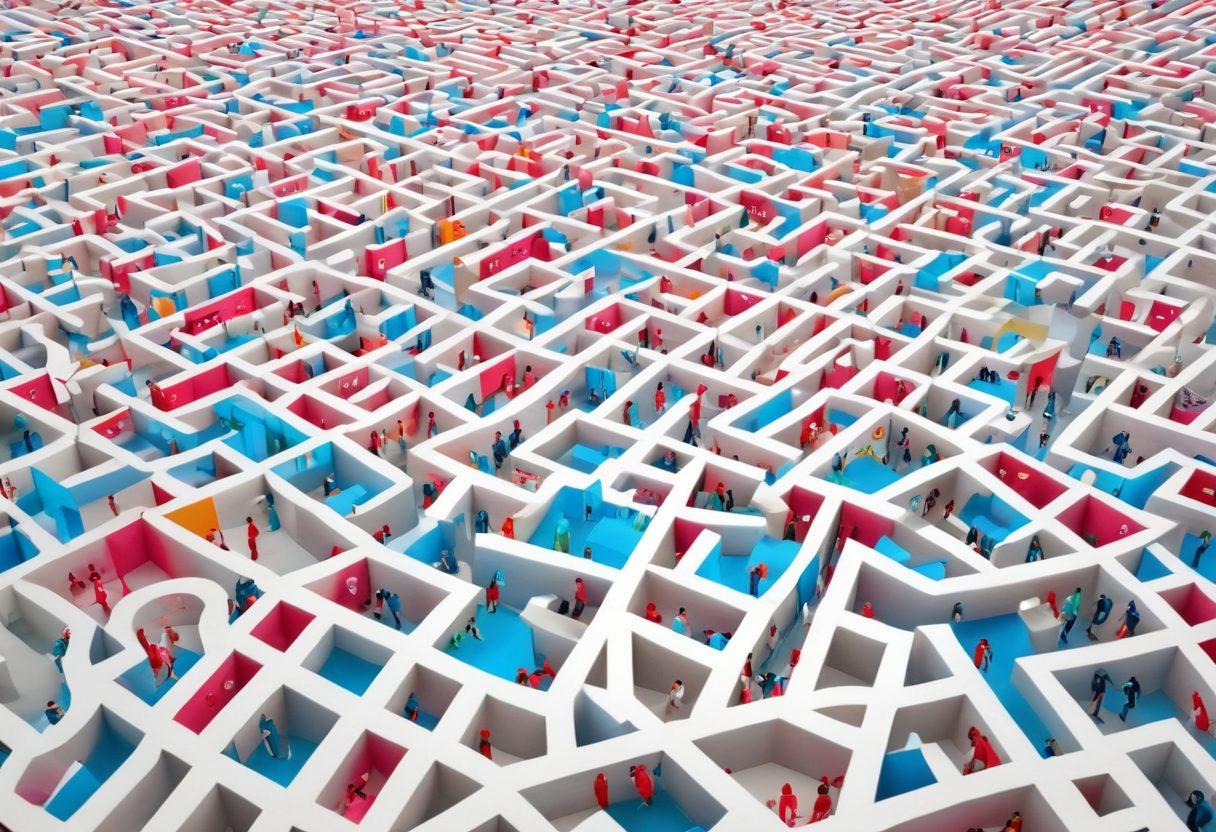

Navigating the Maze of Health Insurance: Your Guide to Affordable Coverage and Benefits

Navigating the intricate world of health insurance can feel like navigating a maze blindfolded. As quickly as you think you've found your way, you might hit a wall, or worse, a dead-end of confusing terms and jargon. But fear not! In this guide, we'll peel back the layers of complexity surrounding affordable health coverage, helping you master your options and benefits while enjoying peace of mind. After all, who doesn’t want to protect themselves and their loved ones against unexpected healthcare expenses?

Imagine this scenario: you've just been handed an insurance policy for the first time, and your head is spinning with unfamiliar terms—deductibles, co-pays, in-network providers—it's overwhelming! But let's start with the basics. Healthcare insurance can be categorized into public health insurance, like Medicaid, and private health coverage that includes individual health insurance and group health insurance. Have you ever wondered which type might be best for you? Each option comes with its unique set of benefits and limitations, tailored to meet different needs. Knowing what you and your family require can illuminate the right path through the maze.

Consider the various health plans available to you: comprehensive health insurance covers a broad range of services, while catastrophic health insurance is designed for emergencies and unexpected health events. Then there’s short-term health insurance, optimal for temporary coverage gaps. Need dental insurance or vision insurance? These supplemental health insurance policies can be added to the mix for enhanced protection. There’s certainly a lot to choose from, and understanding every option is crucial. Are you prepared to weigh the benefits against your budget?

One common hurdle many face is navigating the cost of health insurance policies. Health insurance premiums, deductibles, and out-of-pocket expenses create a trifecta that can be daunting. Picture this: two families with different health histories and budgets are vying for the same comprehensive health insurance plan. How do they know which option provides the best fit? This is where using online health insurance resources and insurance comparison tools comes into play. By gathering insurance quotes from various providers, you can make an informed choice that’s tailored precisely to your needs, ensuring you're not overpaying.

Lastly, let's not overlook the essential health benefits that come into play, such as preventive care coverage. Did you know that many health plans actually cover preventative check-ups at no cost? By taking advantage of these services, you can ward off potential health issues while saving money throughout the year. The key is in understanding your policy specifics and how they align with your healthcare access needs. Remember, becoming proficient in deciphering health insurance is akin to mastering a language. With practice and the right resources, you’ll soon be speaking fluently, navigating the maze with confidence and ease!

From Group to Individual Plans: Tailoring Health Insurance for You and Your Family

Navigating the world of health insurance can feel like wandering through a dense maze where every turn leads to more confusion. With the rising importance of securing healthcare coverage for you and your family, understanding the differences between group and individual health plans is essential. Whether you're a young professional entering the workforce, a parent trying to cover a growing family, or someone simply looking to cut down on healthcare expenses, the quest for affordable healthcare can be overwhelming. However, tailored solutions exist that can make navigating health insurance easier. So, let’s delve into the varieties of insurance available and how they can best suit your needs.

To start, let’s clarify the distinction between group and individual health insurance. Group health insurance is typically offered through employers, which means lower costs due to the number of people covered under one policy. Think about it like a big potluck; the more people contributing to the meal, the less each individual has to bring. These policies often provide comprehensive health insurance that includes preventive care coverage, necessary for early detection and treatment of illnesses. On the other hand, individual health insurance plans are curated specifically for you, allowing for customization based on your healthcare needs, lifestyle, and budget. Would you rather have a feast where everything is predetermined, or create your own menu? That's the beauty of individual plans!

As you ponder over these options, you may find yourself asking, 'What does my family truly need?' For instance, if your family has specific healthcare needs like dental or vision insurance, then an individual plan might suit you better. With tailored coverage, you can select plans with supplemental health insurance that addresses those unique requirements. Many insurance providers offer online health insurance options, making it easier than ever to compare insurance quotes and find policies that fit your needs without breaking the bank. This is where the power of insurance comparison comes into play and can lead you towards a plan that provides both quality and affordability.

But what happens if you find yourself caught in a situation where you are between jobs or need coverage for a short duration? Enter short-term health insurance! These temporary plans can bridge gaps while you secure long-term health benefits. However, it’s essential to understand that they may not cover all essential health benefits, so checking the specifics in terms of deductibles and co-pays is vital. After all, the last thing you want is a hefty out-of-pocket expense when you thought you were covered!

Ultimately, the journey to finding the right health insurance is very much about aligning your values with your needs. Whether you lean towards group health insurance due to its cost-effectiveness or you desire the flexibility of individual health insurance to ensure your unique requirements are met, the choice should center on what makes sense for you and your family. Remember, the right insurance policy should act as a safety net, not a source of stress. As you explore your options, keep in mind the importance of preventive care coverage and choose a plan that empowers you with accessible healthcare solutions. So, take a deep breath, grab those insurance quotes, and embark on creating the best healthcare access for your loved ones.

Navigating Insurance Quotes: A Step-by-Step Approach to Finding the Best Healthcare Solutions

Navigating the labyrinth of health insurance can feel like a daunting challenge. With so many options, terms, and plans swirling around, you might find yourself asking, 'Where do I even start?' Well, fear not! By taking a step-by-step approach to navigating insurance quotes, you can unlock the door to affordable healthcare solutions that truly meet your needs. Armed with understanding, you can sift through the various health plans, ensuring you find a policy that fits your individual or family health coverage requirements while offering essential health benefits.

First things first, let’s demystify what health insurance actually entails. We often hear phrases like 'individual health insurance,' 'group health insurance,' and 'public health insurance,' but what do they all mean? Individual health insurance is typically purchased by a single person for themselves or their family, ensuring coverage that accommodates their specific healthcare needs. Meanwhile, group health insurance is usually offered by employers and covers a collective group of individuals, which can often lead to lower insurance premiums. Creating a foundational understanding of these terms is crucial to making informed decisions when comparing insurance quotes.

Now that we have the basics down, it's time to get your hands dirty! Start by making a list of your healthcare needs. Consider preventive care coverage, routine visits to in-network providers, dental insurance, and even vision insurance. Reflect on your past healthcare expenses and think about how often you utilize medical services. This will help you gauge which health plans will be ideal for you or your family. Don't forget to factor in co-pays and deductibles as you assess different insurance policies, because these can dramatically affect your out-of-pocket expenses.

As you embark on searching for quotes, avoid the temptation to dive into the first option that crosses your screen. It's crucial to conduct insurance comparison across multiple insurance providers. Online health insurance platforms make this process easier than ever. You can quickly access numerous insurance quotes, allowing you to compare not just the premiums but also the types of coverage each policy offers. Remember, affordable healthcare doesn’t always mean choosing the cheapest option; it's crucial to weigh the value of coverage against premium costs. Don't shy away from seeking comprehensive health insurance options that may offer supplemental health insurance coverage for unexpected medical emergencies or catastrophic health insurance for significant health events.

Finally, don’t hesitate to ask questions! Whether it's seeking clarification from an insurance agent or reaching out to friends and family about their experiences with different providers, knowledge is power. Often, a simple conversation can provide insight into which healthcare solutions align with your lifestyle and health needs. As you navigate these insurance quotes, envision yourself empowered—holding the key to your healthcare access, budgeting wisely, and securing a plan that champions your wellbeing. Your journey into the world of health insurance doesn't have to be a maze; by following these steps, you can find clarity and peace of mind.